Healthcare compliance training is a highly important part of any medical organization’s functions....

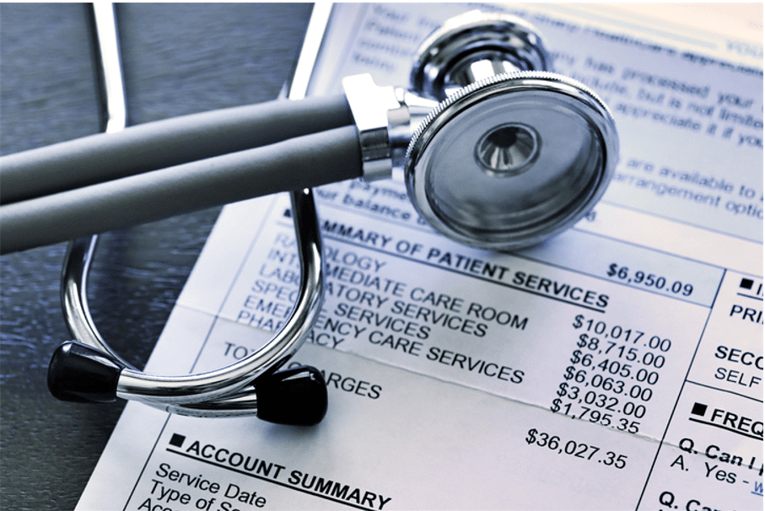

If your medical practice overhead seems to be eating into your revenue, you’re not alone. Research shows that the average medical practice overhead percentage ranges between 60% and 70% of revenue. Which, unfortunately, means a large portion of your income isn’t going into your pocket; it’s going straight to expenses.

Almost every medical practice can lower expenses in some way to reduce overhead. The trick is finding out where and by how much. The following information will get you started in the right direction with:

According to a survey from the Medical Group Management Association (MGMA), medical practice costs include all expenses except provider compensation.

Here’s a typical medical office expenses breakdown:

|

Budget Category |

Expenses |

|

People & Payroll |

|

|

Clinical & Equipment Costs |

|

|

Faculty & Operations |

|

|

Insurance & Marketing |

|

It is a fair assessment to expect support staff expenditures, medical supplies, and facility expenses to create the bulk of your overhead. For smaller medical practices, the average medical practice overhead is even more of a focus.

MGMA research shows that medical practice overhead costs typically take up 60% of practice revenue.

For example, if your monthly revenue is $50,000:

$50,000 x 0.60 = $30,000 in overhead expenses

To calculate your actual medical practice overhead percentage, use the following formula:

(Total operating expenses - provider compensation) ÷ total collections = overhead percentage

To find your practice’s actual numbers, you may need to get your accountant involved. They can tell you your current overhead and how much you’re spending in different areas. If it doesn’t match up with industry benchmarks, you can definitely shave off some expenses.

If you’re looking to lower medical practice overhead, it isn’t just about cutting costs; it’s also about spending smarter. Focus on reducing expenses without compromising care, staff satisfaction, or patient experience.

Here’s a simplified approach to guide your strategy:

The first step in cutting overhead is to take a clear look at where your money is going:

Review financial and operational performance

Compare spending to industry benchmarks

Identify high-cost areas that don’t add enough value

MGMA recommends three core strategies for medical practice overhead reduction:

Increase productivity: Get more from existing resources.

Reduce costs: Eliminate unnecessary or excessive spending.

Improve operations: Streamline workflows to reduce waste.

Let’s get into some proven ways that reduce office overhead.

It isn’t always about dramatic cuts when you’re trying to reduce medical practice overhead; it’s really about making small, strategic changes that add up. Focus on what’s in your control and take action in areas that impact your medical office budget the most.

For any medical practice budget, labor is typically one of the largest items. Ensuring your team structure is aligned with patient volume and operational needs can significantly reduce overhead without sacrificing quality of care.

1. Adjust staffing levels to current patient volume and workflows

2. Cross-train employees to handle multiple roles during busy times

3. Evaluate compensation structures to ensure fair and efficient pay

Fixed monthly expenses, such as insurance or vendor contracts, can slowly drain your medical office budget if repeatedly left unchecked. Be sure to do periodic reviews of these commitments so you can uncover opportunities for savings or renegotiation.

4. Review insurance plans for better rates

5. Shop around for vendor contracts

6. Negotiate lease agreements or find a more cost-effective office space

When processes aren’t standardized, it’s easy for day-to-day clinic operating costs to sneak up on you. By taking control of supply management, recurring fees, and marketing efforts, it can lead to substantial savings in your medical practice overhead.

7. Consolidate supply ordering to avoid duplicates and overstocking

8. Audit phone, internet, and software subscriptions for unnecessary spending

9. Reduce costs in marketing by tracking ROI and hitting pause on low-performing campaigns

10. Improve billing accuracy to avoid refunds or underpayments

Remember: These strategies are extremely useful when you review them quarterly and involve your accountant in the process.

By actively managing your medical practice’s costs, you can create more room in your budget for other growth-driving investments, such as new technologies or additional staff for support.

Once you’ve reviewed the areas you can cut expenses, it’s time to look at how to best use your revenue. Rather than spending randomly or reactively, invest in upgrades that improve patient experience, streamline operations, and reduce future overhead.

One effective and impactful way to reinvest your funds is by partnering with a management services organization (MSO). MSOs can help manage non-clinical functions like billing, IT, staffing, and compliance – allowing your internal team to focus more on patient care. It’s an easy investment that can exponentially increase your productivity, lower office overhead, and put you in a better position in today’s hectic healthcare landscape.

Take control of your medical practice budget with proven strategies for reducing costs, improving operations, and increasing revenue. But first, it’s time for another calculation: one that defines your missed new-patient opportunities:

(Editor's note: This blog was originally published in March 2022 and was recently updated in September 2025 to reflect current information.)

Healthcare compliance training is a highly important part of any medical organization’s functions....

When the calendar flips, medical practices often feel it immediately. Claim denials increase,...

In a busy practice, the day can feel like it’s running you instead of the other way around. When...

Getting a Texas physician license can feel like a test of patience long before you ever see a...

Running a private practice already demands enough from you. Adding hours of administrative work on...

Running a medical practice involves managing dozens of ongoing costs, and understanding them is...

A Texas physician opened a new practice with everything in place – staff hired, patients scheduled,...

Your biller is three weeks behind on claims. Two no-shows went unfilled this morning. Your office...

Every minute spent chasing paperwork or fixing scheduling issues is time taken away from patients....