HIPAA compliance represents a cornerstone of trust and security in the healthcare sector,...

The Physician Self-Referral Law, also known as Stark Law, bans physicians from referring patients to “designated health services” payable by health coverage programs such as Medicare or Medicaid with which the physician or an immediate family member has a financial relationship (unless a rare exception applies).

In short, Stark Law says you cannot refer patients to other health care professionals in exchange for anything of value. The law is intended to protect patients from unnecessary procedures and medical bills. It applies to privately owned medical practices as well as larger medical care providers.

The following companies in these Stark Law cases knew what they were getting into. Let’s see where it got them.

Allegations:

Final payout: $115,000.00

Allegations:

Final payout: $24,500,000.00

Allegations:

Final payout: $237,000,000.00

Allegations:

Final payout: $3,200,000.00

Allegations:

Final payout: $18,800,000

Allegations:

Final payout: $2,900,000

Allegations:

Final payout: $10,000,000

Allegations:

Final payout: $108,000,000

Allegations:

Final payout: $22,000,000

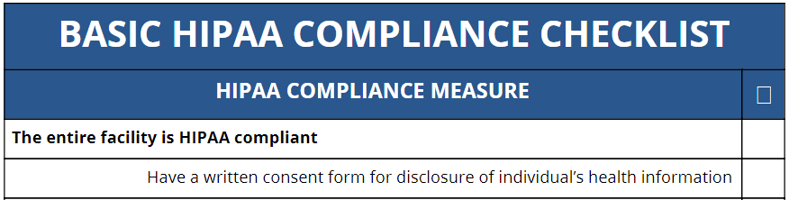

Want to read more medical non-compliance stories? Check out this article on Social Media HIPAA Violations. You can also grab the HIPAA Compliance Checklist to review compliance for your practice.

For more Stark Law information, consider these resources:

Not sure if your practice is compliant? Contact us for a free practice analysis to identify any compliance and liability issues.

(Editors note: This blog was originally published in Jan of 2022 and was updated in December 2023 to reflect current and updated information)

HIPAA compliance represents a cornerstone of trust and security in the healthcare sector,...

Medical care is necessary to prevent diseases and improve quality of life. With many doctors...

A significant portion of patient outreach and engagement happens online. The digital age has...

In the ever-evolving healthcare landscape, 2024 has brought about a pivotal shift in how physicians...

Bookkeeping for medical practices can be a complicated process. Technology may be the resource you...

When you've been with a medical practice for a while, it can be hard to imagine leaving. After all,...

The Physician Self-Referral Law, also known as Stark Law, bans physicians from referring patients...

Addison Internal Medicine has spent a decade working toward what it is today: a premier destination...

Leave a Comment